Spending on your terms

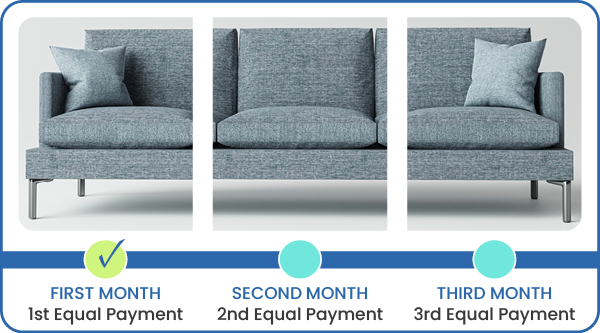

Buy Now, Pay Later is an installment payments program that allows you to divide large qualifying purchases into monthly payments.

What is Buy Now Pay, Later?

Using the WCCU eBanking app, WCCU Credit Card cardholders now have the option to split up large qualifying purchases over three, six, or twelve equal monthly payments at a lower interest rate. This gives you - the cardholder - more control over your purchases and repayment options than ever before.

How do installment payments work?

After downloading the WCCU eBanking App, you’ll see your recent transactions - including those eligible for Installment Payments. After making your qualifying purchase, select Account Activity and choose Installment Plans. Then you can select your purchase, choose between your repayment options, and repay that purchase - on your terms!

- Step 1: Once you enroll in eBanking, you can then download our app for your iPhone®, iPad® or Android™

- Step 2: Make qualifying purchases at your favorite retailer

- Step 3: Select your qualifying purchase and repayment option

- Click your credit card from the dashboard account list then select the Card Services tab

- Click on the Installment Plans tile

- Once the screen opens you will see if there are any offers based on your recent purchases

- Submit the transaction and receive the confirmation on your request

- Step 4: Pay back your purchase on your terms

FAQs

The Installment Payments program lets you pay off eligible purchases over a set period of time with a fixed APR and fixed monthly payments.

- Click your credit card from the dashboard account list then select the Card Services tab

- Click on the Installment Plans tile

- Once the screen opens you will see if there are any offers based on your recent purchases

- Submit the transaction and receive the confirmation on your request

Purchases that are over $250 and display in the Installment Payments tab are eligible. Purchases that already appear on your monthly statement, are disputed or claimed as fraudulent, and/or are already included in a promotional APR or special financing may not be eligible.

You may have up to 10 active plans on your account at a time. As Installment Payment Plans are paid off, you will be able to view new eligible purchases.

There’s no need to make any separate payments for your active Installment Payment Plans. We’ll automatically add the monthly Installment Payment Plan payment(s) to your minimum payment due each billing cycle. Pay at least your minimum payment when it’s due each billing cycle, and you’ll pay off your Installment Payment Plan balance on time.

here is no penalty for paying off your Installment Plan Balance early. If a payment is made in the amount of the New Balance indicated on your statement that would include the entire Installment Plan Balance. Any payment made in excess of the minimum payment due will be applied to the highest interest rate balance first.

If you normally pay off your credit card balance in full and do not revolve a balance, you can accept an Installment Payment Plan offer and avoid paying interest on the remaining balance on your credit card.

Making a payment in the amount of the Interest Avoidance Balance, displayed on your monthly statement, will pay off your new purchases and include your monthly Installment Payment Plan payment. This will allow you to avoid interest charges on your new (non-Installment) purchases and make your monthly payment towards your Installment Payment Plan without paying the entire Installment Plan Balance off early.

Making a payment in the amount of the Interest Avoidance Balance, displayed on your monthly statement, will pay off your new purchases and include your monthly Installment Payment Plan payment. This will allow you to avoid interest charges on your new (non-Installment) purchases and make your monthly payment towards your Installment Payment Plan without paying the entire Installment Plan Balance off early.

Your account balance will update within two business days.

If you’d like to have an extra payment applied specifically to your Installment Payment Plan, please call 401.596.7000 for assistance.

Installment Payment Plans cannot be changed or modified once they are accepted.

No. Setting up an Installment Payment Plan will not increase your available credit.

Your Installment Payment Plan will remain active even if you miss a payment. We’ll add your past-due Installment Payment Plan monthly payment to your minimum payment due on the next month’s statement.

Keep in mind, missing a payment may prevent you from paying off your plan within the time period you chose and cause your credit card account to be considered delinquent. You may also be charged a late fee.

Please review your credit card terms and conditions for information about late fees. If you are having trouble making your payments, or need assistance in accessing your credit card terms and conditions, please call 401.596.7000.

Keep in mind, missing a payment may prevent you from paying off your plan within the time period you chose and cause your credit card account to be considered delinquent. You may also be charged a late fee.

Please review your credit card terms and conditions for information about late fees. If you are having trouble making your payments, or need assistance in accessing your credit card terms and conditions, please call 401.596.7000.

If you return a purchase that’s in an Installment Payment Plan and receive a merchant credit for that purchase, you’ll need to call us at 401.596.7000 to have the credit applied to your Installment Payment Plan balance.

If you dispute a purchase which was converted to an Installment Payment Plan, your monthly Installment Amount(s) due will be suspended until it is resolved. You will not be charged installment interest during this time.

If the dispute is not decided in your favor, your installment plan may be canceled. You will be responsible for paying the disputed amount, which will be reflected as a purchase in your standard account balance and included in the calculated minimum payment due.

If you receive a merchant credit for a disputed purchase that is in an Installment Payment Plan, you'll need to call us at 401.596.7000 to have the credit applied to your plan balance.

If the dispute is not decided in your favor, your installment plan may be canceled. You will be responsible for paying the disputed amount, which will be reflected as a purchase in your standard account balance and included in the calculated minimum payment due.

If you receive a merchant credit for a disputed purchase that is in an Installment Payment Plan, you'll need to call us at 401.596.7000 to have the credit applied to your plan balance.

No, only the owner(s) of an account can create an Installment Payment Plan.

If your original purchase earned rewards, you will retain those rewards even if that purchase is converted into an Installment Payment Plan

Some exclusions apply, including, but not limited to, balance transfers, cash advances, international purchases and purchases under $100. If you have additional questions, please call 401.596.7000.

You may want to make changes to your automatic payment settings to avoid paying your Installment Payment Plan off early.

If you are currently set to pay the Full Statement Balance, your entire Installment Payment Plan balance will be included in that payment amount.

If you are set to pay the Minimum Payment due, that will include your Installment Payment Plan monthly payment.

If you have questions regarding automatic payments, how you are set up or to make changes on your due date, call us at 401.596.7000.

If you are currently set to pay the Full Statement Balance, your entire Installment Payment Plan balance will be included in that payment amount.

If you are set to pay the Minimum Payment due, that will include your Installment Payment Plan monthly payment.

If you have questions regarding automatic payments, how you are set up or to make changes on your due date, call us at 401.596.7000.

Yes, the details of your Installment Payment Plans will appear on your monthly statement. The detail will include the installment term, date and amount of the original transaction, monthly payment, fixed APR, balance subject to interest rate, interest charge, and remaining balance. It will also display the Interest Avoidance Balance calculation.

A purchase that has been converted into an Installment Payment Plan will appear as three transactions on your statement: original transaction at purchase date, repost transaction showing the purchase posted as an Installment Payment as of the accepted offer date, and an adjustment crediting the original transaction amount.